Main Content

Blog

Blogs

What Local Plants Grow Best on Residential Land in Barbados?

Barbados, known for its stunning beaches and lush landscapes, offers an ideal environment for various local plants. If you’re a homeowner, expatriate, or luxury traveler investing in residential property, incorporating native plants into your garden can enhance aesthetics and sustainability.

Read More

Things To Consider When Budgeting Rentals Abroad

Are you dreaming of an escape to Barbados's pristine beaches and azure waters? Renting a high-end vacation property abroad requires careful planning, especially when considering the intricacies of budgeting. Using a measured approach, you can secure the perfect rental property while avoiding unforeseen financial surprises. Here are a few things to consider when budgeting rentals abroad and how to retreat to Barbados like a seasoned traveler.

Read More

All About Barbadian Life and How To Navigate It as an Expat

Barbados offers an enviable lifestyle that has drawn expats and high-end travelers from across the globe. Its sun-kissed beaches, vibrant local culture, and sophisticated amenities make it an ideal location for those seeking relaxation and adventure. Beyond its natural beauty, the island boasts modern infrastructure, excellent health care, and a stable economy, making it a secure haven for expats looking to start anew.

Read More

Houses vs. Villas in Barbados: Which Is Right for You?

Barbados offers incredible living options, but choosing between a house and villa depends on your lifestyle, priorities, and long-term plans. Both provide unique advantages tailored to different needs, and understanding these options is key to finding your perfect property in paradise. Here’s what you need to know to determine whether a house or villa in Barbados is right for you.

Read More

Waterfront Living in Barbados: Advantages and Considerations

Barbados, a Caribbean gem, embodies the perfect blend of natural beauty and luxury. Its breathtaking waterfront properties are a dream for homebuyers seeking unparalleled serenity, exclusivity, and convenience. Our guide covers the advantages and considerations of waterfront living in Barbados to help you make your next real estate move.

Read More

What To Expect Running an Airbnb in Barbados as an Expat

If you’ve dreamed of running an Airbnb in a tropical paradise, Barbados offers an incredible opportunity. Its vibrant culture and thriving tourist economy make it a sought-after destination. But managing a property in a foreign country comes with unique challenges and rewards. From understanding local regulations to connecting with the community, there’s plenty to expect when running an Airbnb in Barbados as an Expat.

Read More

All About Finding the Neighborhood for You in Barbados

Finding the perfect place to live in Barbados means knowing your ideal lifestyle. From serene coastal retreats to vibrant urban hubs, every neighborhood has a unique charm. Whether you’re looking for luxury homes or a community feel, Barbados offers something for everyone. Here’s all you need to know about finding the best neighborhood for you.

Read More

Dos and Don’ts as a Landowner During Barbados’s Dry Season

Barbados’s dry season may be synonymous with blue skies and golden sands, but land ownership during this period requires extra awareness. Taking the right precautions will ensure your property stays vibrant and resilient, which means knowing what to prioritize and what to steer clear of is essential. Here are the dos and don’ts to keep in mind as a landowner during Barbados’s dry season.

Read More

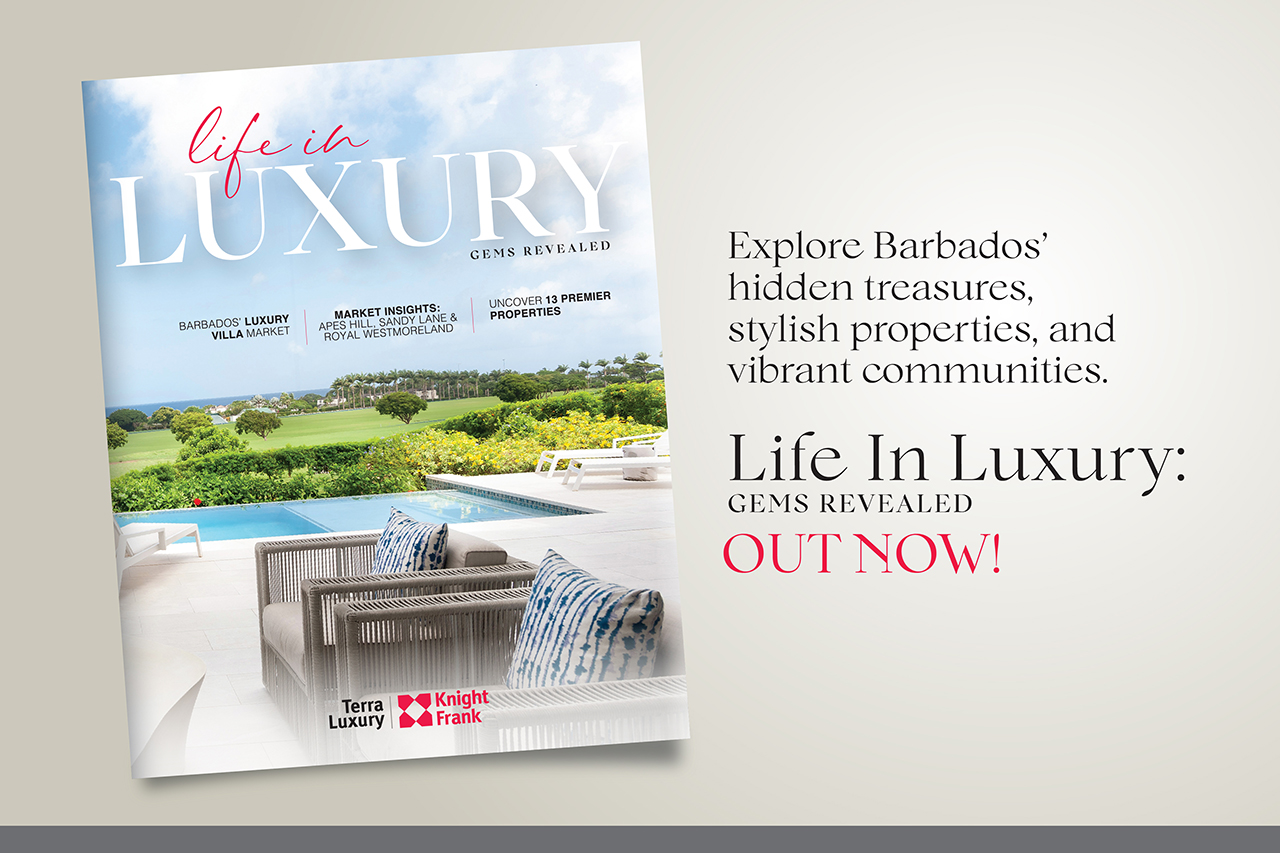

The Luxury List 2025

Welcome to Life In Luxury: Gems Revealed, where we explore Barbados' hidden treasures, stylish properties, and vibrant communities.

Read More

Tips To Prepare Your Vacation Home for Showings

Making a great first impression is essential when showing your vacation home to prospective buyers. With the right preparation, you can highlight the property’s best features and charm potential owners instantly. Follow these tips to prepare your vacation home for showings.

Read MoreRecent Posts

Categories

Archives

- May 2025 (1)

- April 2025 (2)

- March 2025 (2)

- February 2025 (1)

- January 2025 (4)

- December 2024 (4)

- November 2024 (2)

- October 2024 (11)

- September 2024 (1)

- August 2024 (1)

- July 2024 (2)

- June 2024 (2)

Authors

- Anna Lee Warren, Real Estate Agent (1)

- Betty Cathrow & Emma Hutson Real Estate Agent (1)

- Betty Cathrow, Real Estate Agent (1)

- Jeanie Mahon & Anna Lee Warren Real Estate Agent (1)

- Jeanie Mahon-Dupire (1)

- Karyn Fakoory, Real Estate Agent (1)

- Laura Rotchell, Real Estate Agent (2)

- Rachel Edwards (1)

- Terra Caribbean (1)

- Terra Caribbean Barbados (1)

- Terra Luxury (116)

Navigate the luxury market with confidence and expertise.